140ez 2015 Form

Form 1040 (Schedule A) Itemized Deductions 2016 Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040), Itemized Deductions 2015 Form 1040 (Schedule A) Itemized Deductions 2015 Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040), Itemized Deductions 2014.

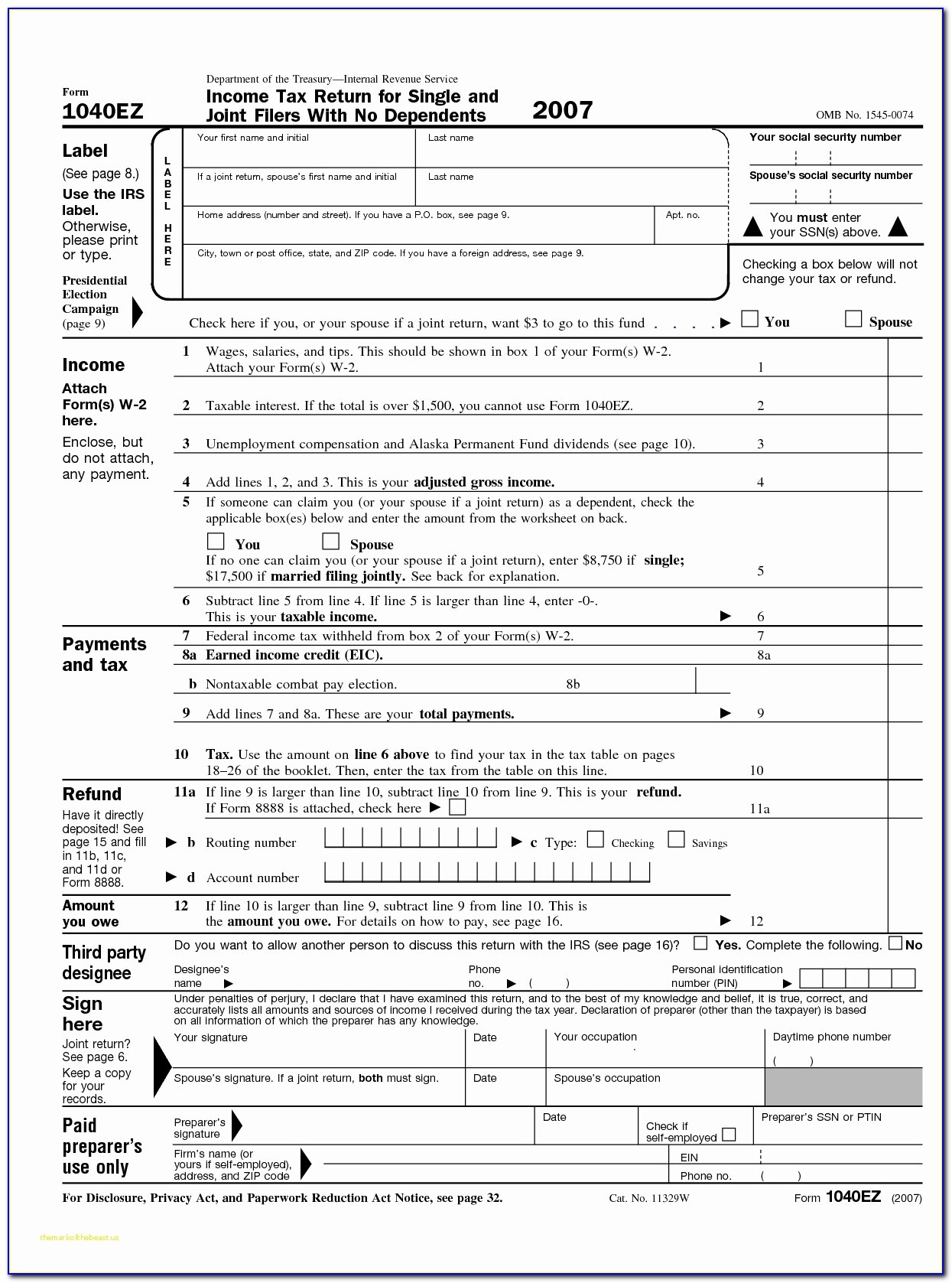

You May Benefit From Filing Form 1040A or 1040 in 2015 Due to the following tax law changes, you may benefit from filing Form 1040A or 1040, even if you normally file Form 1040EZ. See the instructions for Form 1040A or 1040, as applicable. Requirement to reconcile advance payments of the premi. If you can claim the premium tax credit or you received any advance payment of the premium tax credit in 2015, you must use Form 1040A or Form 1040. You had only wages, salaries, tips, taxable scholarship or fellowship grants, unemployment compensation, or Alaska Permanent Fund dividends, and your taxable interest was not over $1,500. Employer may be required to send you a Form 1095-C. Part II of Form 1095-C shows whether your employer offered you health insurance coverage and, if so, information about the of-fer. This information may be relevant if you purchased health insurance coverage for 2015 through the Health Insurance Mar. Form 140EZ Routing Number Form 140EZ is not considered a valid return unless you sign it. The department cannot send a refund check if you, and your The routing number must be 9 digits. The first 2 digits must spouse if married filing jointly, fail to sign the return. Be 01 through 12 or 21 through 32.

1040ez Form Instructions

Printable PDF Files

2015 1040ez Instructions Irs

Update: 2015 1040EZ Form and 2015 1040EZ Instructions links above are the correct links to use as of March 7, 2017. This is a popular but outdated post so we wanted you to know. You can find more 2015 Forms and Instructions on our 2015 1040 Form page.

The IRS has already updated many of this year's income taxforms including the 2015 Form 1040EZ. The instructions booklet for 2015 Form 1040EZ, however,has not yet been updated. If you are in a hurry to draft your 2015 Form 1040EZ, we can only suggestthat you search the 2015 Publication 17 book to guide you. IRS Pub 17 is not meant to replace formspecific instructions such as those for the Form 1040EZ. Pub 17 does however include the IRS incometax tables and other useful information.

The IRS urges all taxpayersto make sure they have all of their income tax return filing information on hand before submitting their2015 forms. Forms W-2 from employers, Forms 1099 from banks and sub-contract work, and other importanttax documents are generally not due until February 1, 2016. For most people, drafting your Form 1040EZmight be helpful. Submitting it early to the IRS might not be helpful. The IRS will not begin processingpaper or efiled income tax returns until January 19, 2016.

Not a Form 1040EZ filer? You can obtainthe printable PDF files for Form 1040A andlong form Form 1040 here.

2015 Form 1040ez

Last updated: March 7, 2017